Excluding properties in Northern Ireland. Your property may be at risk if you do not keep up with payments. T&Cs apply.

ADCB | Nomo

Invest in UK rental property

Discover new income opportunities with Nomo’s Sharia-compliant property finance. Buy or refinance a rental property in the UK with fixed term rates from 4.35%.

Why bank with Nomo?

What is Nomo?

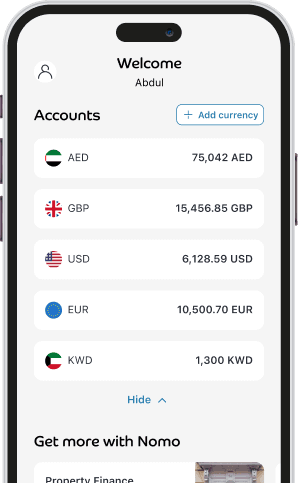

Nomo is a Shari’ah-compliant digital bank based in the UK.

ADCB has partnered with Nomo to offer UK banking services to UAE citizens and residents.

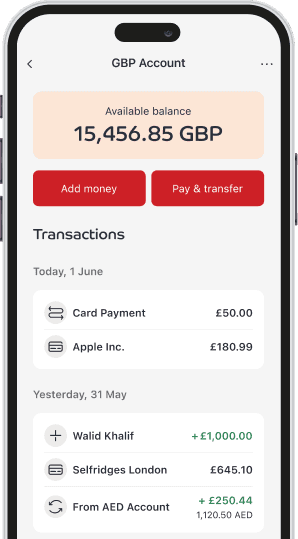

| Fee-free global spending | |

| GBP, USD and EUR Fixed Term Deposits | |

| Zero account fees and no minimum balance |

Nomo accounts are not currently available to UK residents.

Who is Nomo for?

Nomo is perfect for:

| Frequent international travellers | |

| International investors | |

| Potential UK property investors | |

| International students and their parents |

Please note, Nomo accounts are not currently available to UK residents.

Scan the QR code to install ADCB | Nomo

Download the app

Have your physical passport and Civil ID / proof of address with you

Have your documents ready

Record a short video so we can verify your ID

Complete the onboarding questions

Answer some simple questions about yourself and your finances

Submit your application

Submit your application and you’re on the way to joining Nomo!

FAQ's

Discover the answers to some commonly asked questions

Download the ADCB | Nomo app from the App Store or Google Play. The application process can be completed from your smartphone.

You need your physical passport and Emirates ID.

Secure banking

Your wealth is safeguarded with UK standard bank grade security.

FSCS protected

Deposits up to £120,000 are covered by the FSCS protection scheme.

Sharia-compliant banking

Banking that’s open, clear and based on the principles of Islamic finance.

Nomo by Bank of London and The Middle East plc (“BLME”) is a trading name of BLME. BLME is registered in England and Wales (no. 05897786), authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. BLME’s Financial Services Register number is 464292 and registered office is at 20 Churchill Place, Canary Wharf, London E14 5HJ.

We will collect and process information about you that may be subject to data protection laws. For more information about how we use and disclose your personal data, how we protect your information, our legal basis to use your information, your rights and who you can contact, please see our privacy notice.